Top Stories

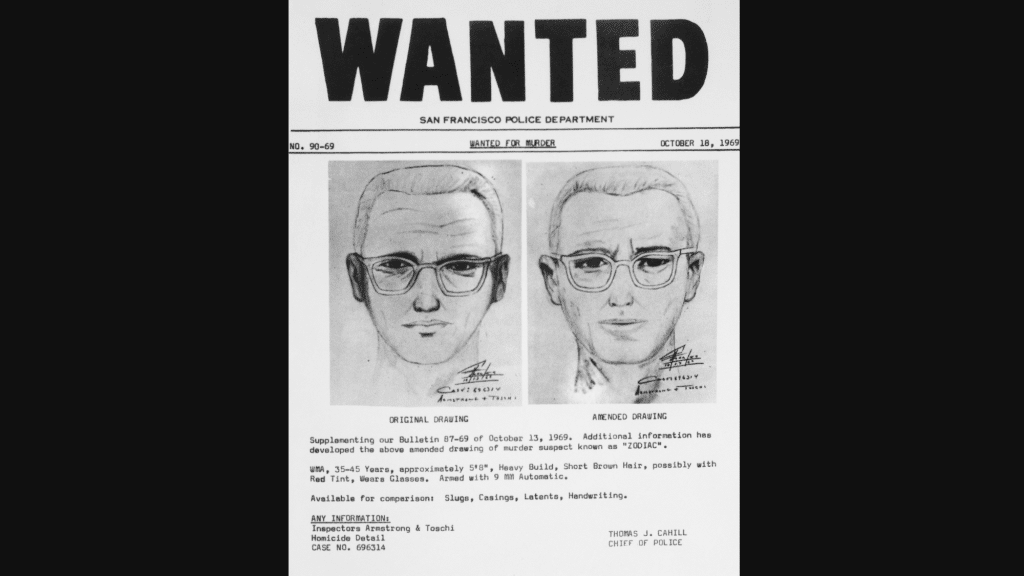

The Zodiac Killer case remains one of America’s unsolved mysteries, having captured the attention of true crime enthusiasts and investigators for over five decades. If you are searching for the most recent news, updates, and developments related to the Zodiac

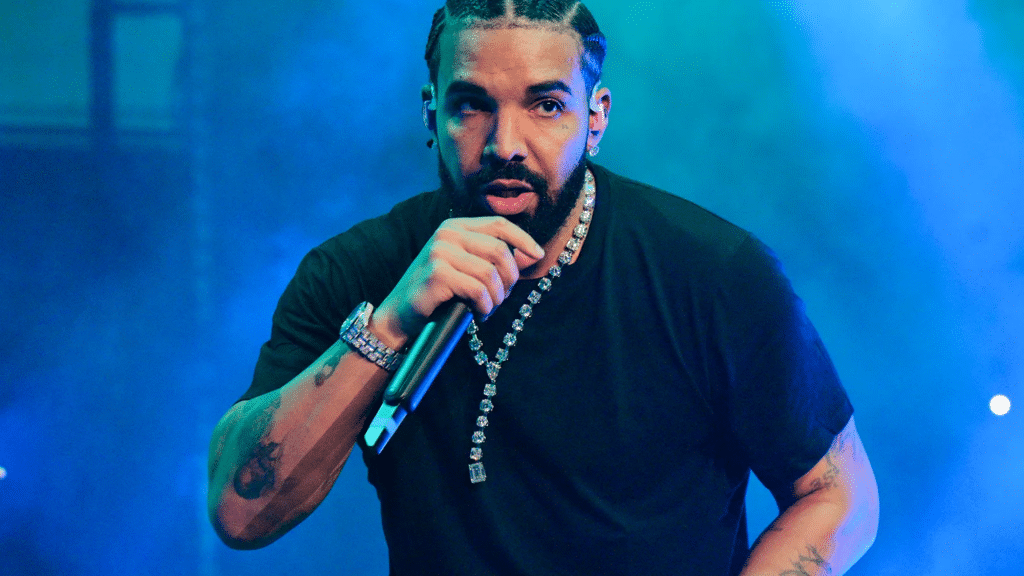

Are you curious about how many albums Drake has released so far? We have got you covered! From his start on Degrassi to becoming one of the biggest names in music, Drake has dropped hit after hit. But with studio

LATEST

Top Stories

Well, it starts out as “just a quick match”, right after you get off of work. Then somehow it’s 11:47 p.m., the jaw is clenched, the shoulders are up by the ears, and the whole house can feel the tension

LATEST

Top Stories

Ever started packing a home and realized halfway through the day that your back hurts, your schedule is off, and nothing is where you thought it was? It usually hits when boxes start stacking in the wrong rooms, and you’re

Welcome to cuindependent, your space for bold ideas, fresh perspectives, and engaging stories. We bring you content that informs, inspires, and sparks conversation.

Stay connected — subscribe to our newsletter and never miss an update!

Explore

Our Picks

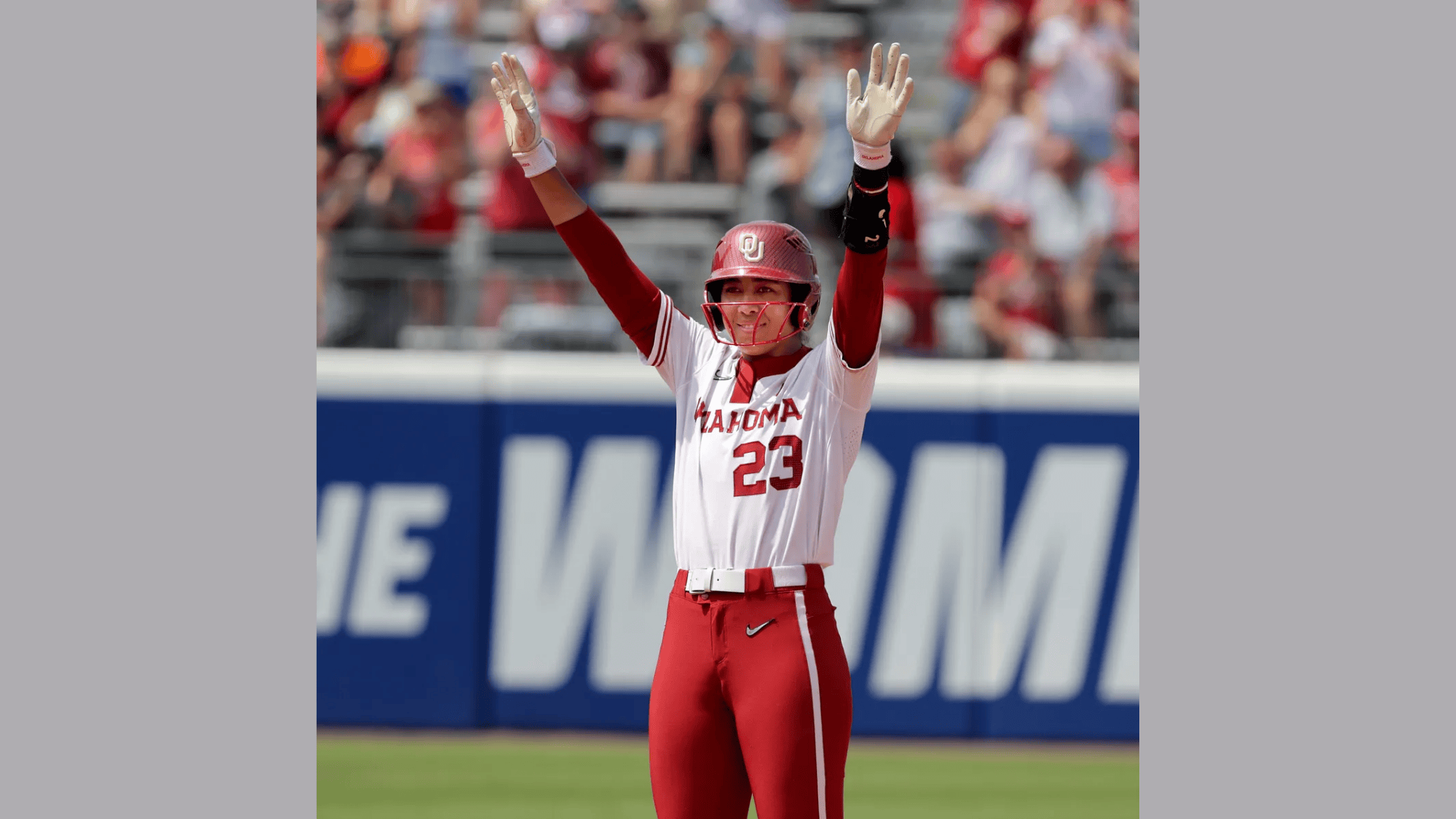

From inspiring artistry to achievements in sports and beyond, we bring the highlights.

A curated view of stories shaping conversations across fields today.

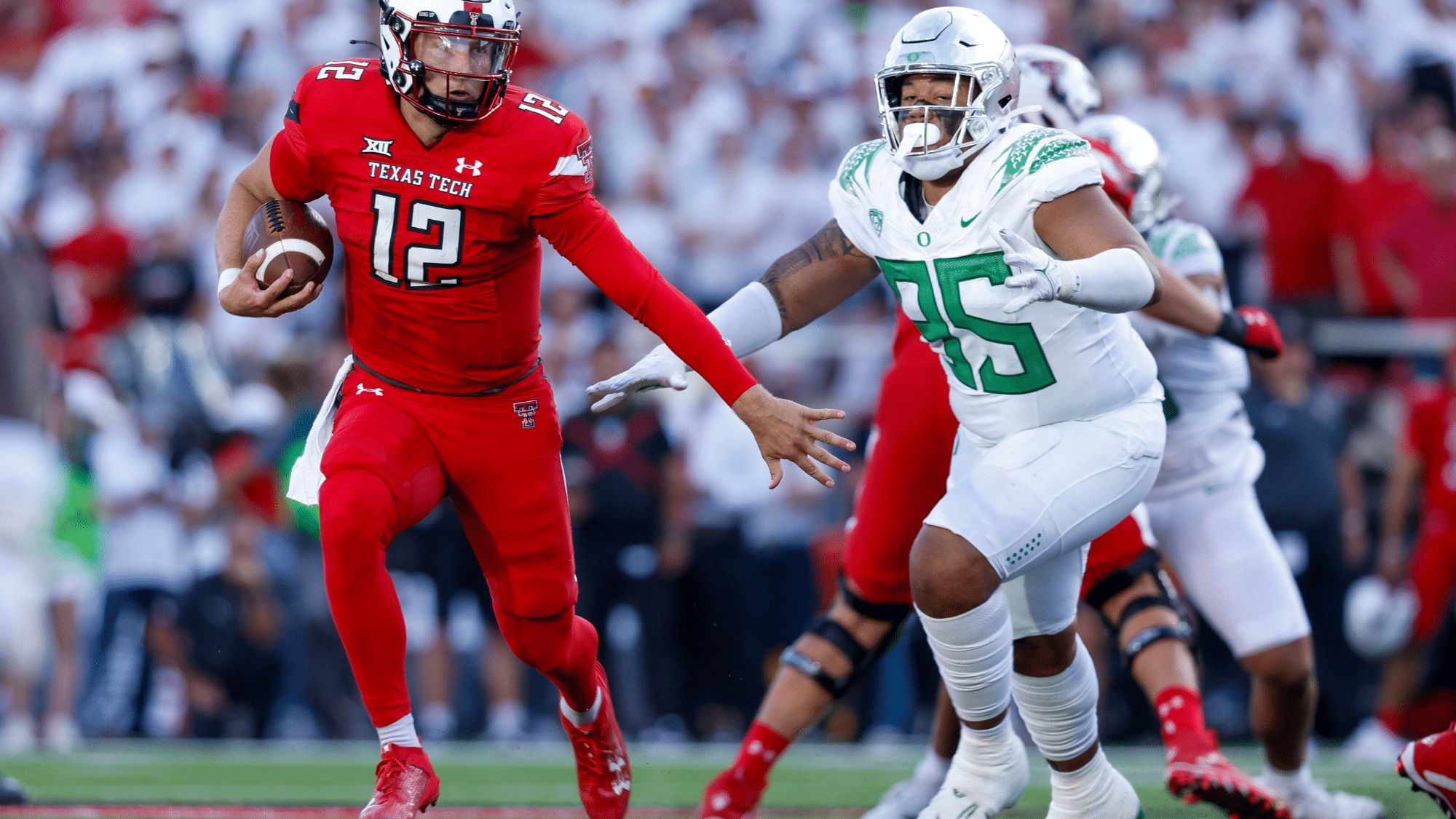

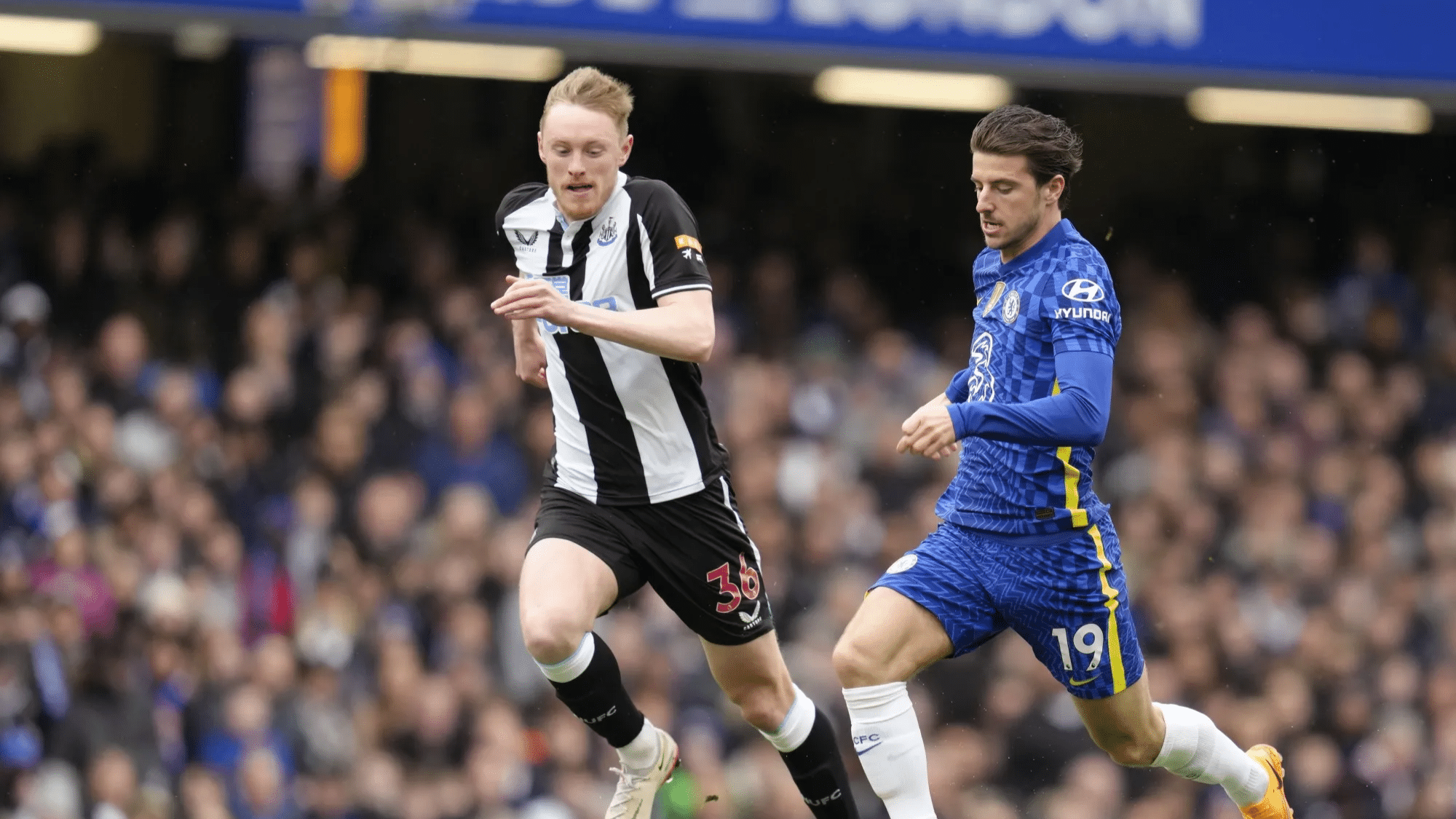

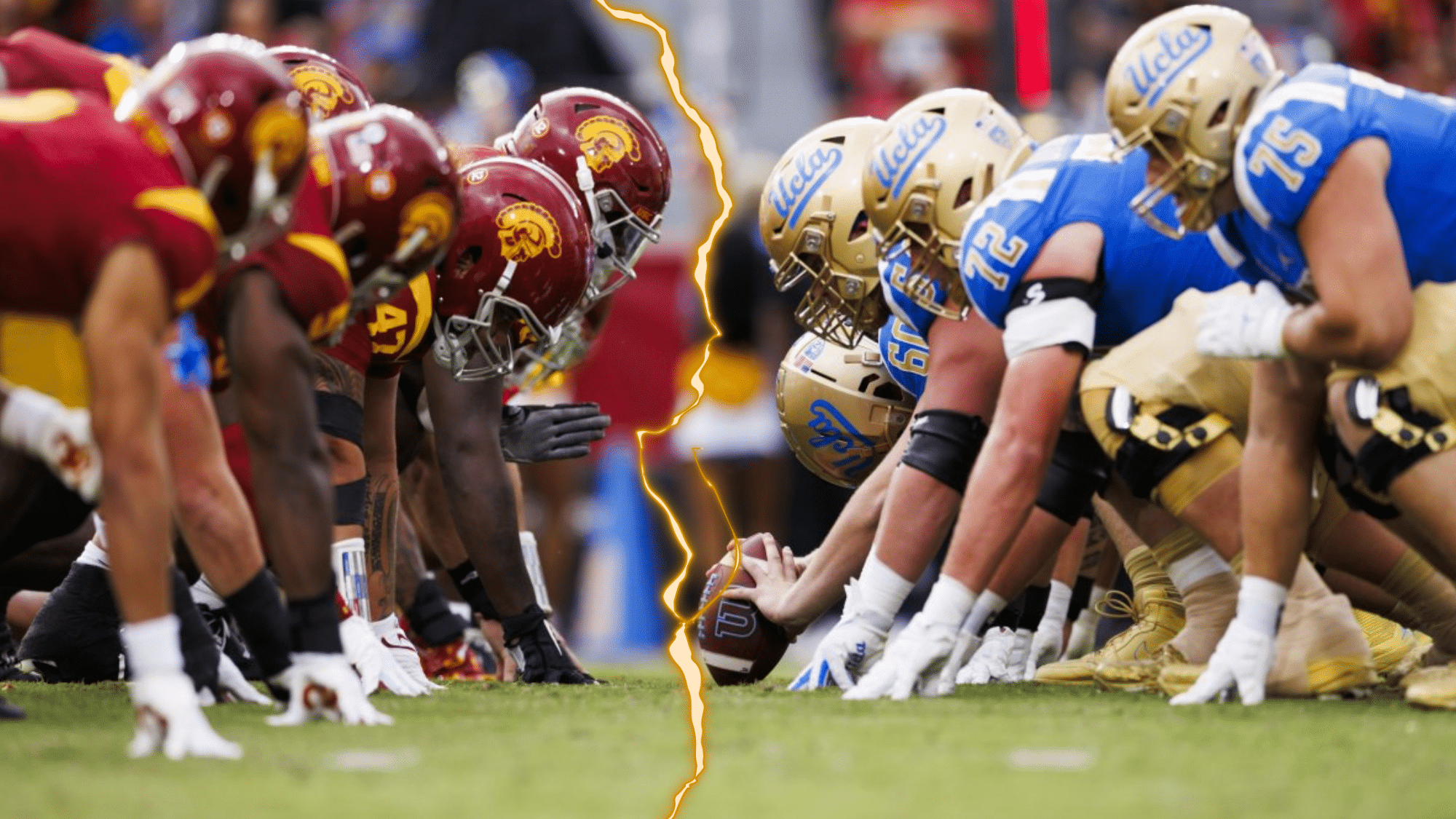

Some games aren’t just played, they are felt in the soul. These iconic rivalries go beyond the scoreboard, turning into battles of pride, passion, and identity that echo across generations. Whether it’s football in Argentina or cricket in India, these matchups light up stadiums, stir entire nations, and write unforgettable chapters.....

Fall is a magical season filled with vibrant colors, changing leaves, and endless creative inspiration. For teachers and parents, it’s the perfect time to introduce fall art projects that help children explore textures, colors, and nature while developing fine motor and creative skills. If you’re planning a classroom craft or.....

more

Meet Our Team

At CU Independent, we’re committed to delivering real, bold, and honest stories. Get to know the passionate team behind the content!

Samantha Lee

(Editor-in-Chief)

Dr. Alex Thompson

(Senior Features Writer)

Meet Our Team

Hootie & the Blowfish is a beloved American rock band, best known for their chart-topping hits in the 1990s. Formed in 1986 in Charleston, South Carolina, the band quickly rose to fame with their unique blend of pop, rock, and blues. Their catchy songs and relatable lyrics connected with fans, making.....

A healthy smile is built on small habits you repeat every day. The good news is that most of these steps are simple and low-cost. With a few tweaks to brushing, flossing, diet, and checkups, you can cut your risk of cavities and gum disease and keep your breath fresh. Brush.....

Solitaire is a game that has been kicking around for some time now, and it’s an accessible way to sharpen one’s cognitive skills and offer plenty of other benefits, such as reducing stress and improving focus. As a low-pressure, solitary game, this is a gentle mental activity that allows the brain.....

The heart of our home often shows the most wear — we all know that. It’s a beloved sofa that’s seen countless movie nights, the dining chair that’s survived art projects and spaghetti dinners, the armchair that’s your pet’s favorite napping spot. But what if you could protect those cherished pieces.....

Our Contributors

As Seen On